Universal Commerce Protocol (UCP) Official Specification¶

Version: 2026-01-11

Overarching guidelines¶

The key words MUST, MUST NOT, REQUIRED, SHALL, SHALL NOT, SHOULD, SHOULD NOT, RECOMMENDED, MAY, and OPTIONAL in this document are to be interpreted as described in RFC 2119 and RFC 8174.

Schema notes:

- Date format: Always specified as RFC 3339 unless otherwise specified

- Amounts format: Minor units (cents)

Discovery, Governance, and Negotiation¶

UCP employs a server-selects architecture where the business (server) chooses the protocol version and capabilities from the intersection of both parties' capabilities. Both business and platform profiles can be cached by both parties, allowing efficient capability negotiation within the normal request/response flow between platform and business.

Namespace Governance¶

UCP uses reverse-domain naming to encode governance authority directly into capability identifiers. This eliminates the need for a central registry.

Naming Convention¶

All capability and service names MUST use the format:

Components:

{reverse-domain}- Authority identifier derived from domain ownership{service}- Service/vertical category (e.g.,shopping,common){capability}- The specific capability name

Examples:

| Name | Authority | Service | Capability |

|---|---|---|---|

dev.ucp.shopping.checkout |

ucp.dev | shopping | checkout |

dev.ucp.shopping.fulfillment |

ucp.dev | shopping | fulfillment |

dev.ucp.common.identity_linking |

ucp.dev | common | identity_linking |

com.example.payments.installments |

example.com | payments | installments |

Spec URL Binding¶

The spec and schema fields are REQUIRED for all capabilities. The origin

of these URLs MUST match the namespace authority:

| Namespace | Required Origin |

|---|---|

dev.ucp.* |

https://ucp.dev/... |

com.example.* |

https://example.com/... |

Platform MUST validate this binding and SHOULD reject capabilities where the spec origin does not match the namespace authority.

Governance Model¶

| Namespace Pattern | Authority | Governance |

|---|---|---|

dev.ucp.* |

ucp.dev | UCP governing body |

com.{vendor}.* |

{vendor}.com | Vendor organization |

org.{org}.* |

{org}.org | Organization |

The dev.ucp.* namespace is reserved for capabilities sanctioned by the UCP

governing body. Vendors MUST use their own reverse-domain namespace for

custom capabilities.

Services¶

A service defines the API surface for a vertical (shopping, common, etc.). Services include operations, events, and transport bindings defined via standard formats:

- REST: OpenAPI 3.x (JSON format)

- MCP: OpenRPC (JSON format)

- A2A: Agent Card Specification

- EP(embedded): OpenRPC (JSON format)

Service Definition¶

| Field | Type | Required | Description |

|---|---|---|---|

version |

string | Yes | Service version (YYYY-MM-DD format) |

spec |

string | Yes | URL to service documentation |

rest |

object | No | REST transport binding |

rest.schema |

string | Yes | URL to OpenAPI spec (JSON) |

rest.endpoint |

string | Yes | Business's REST endpoint |

mcp |

object | No | MCP transport binding |

mcp.schema |

string | Yes | URL to OpenRPC spec (JSON) |

mcp.endpoint |

string | Yes | Business's MCP endpoint |

a2a |

object | No | A2A transport binding |

a2a.endpoint |

string | Yes | Business's A2A Agent Card URL |

embedded |

string | No | Embedded transport binding |

embedded.schema |

string | Yes | URL to OpenRPC spec (JSON) |

Transport definitions MUST be thin: they declare method names and reference base schemas only. See Requirements for details.

Endpoint Resolution¶

The endpoint field provides the base URL for API calls. OpenAPI paths are

appended to this endpoint to form the complete URL.

Example:

"rest": {

"schema": "https://ucp.dev/services/shopping/rest.openapi.json",

"endpoint": "https://business.example.com/api/v2"

}

With OpenAPI path /checkout-sessions, the resolved URL is:

Rules:

endpointMUST be a valid URL with scheme (https)endpointSHOULD NOT have a trailing slash- OpenAPI paths are relative and appended directly to endpoint

- Same resolution applies to MCP endpoints for JSON-RPC calls

endpointfor A2A transport refers to the Agent Card URL for the agent

Capabilities¶

A capability is a feature within a service. It declares what functionality is supported and where to find documentation and schemas.

Capability Definition¶

| Name | Type | Required | Description |

|---|---|---|---|

| name | string | Yes | Stable capability identifier in reverse-domain notation (e.g., dev.ucp.shopping.checkout). Used in capability negotiation. |

| version | string | Yes | Capability version in YYYY-MM-DD format. |

| spec | string | Yes | URL to human-readable specification document. |

| schema | string | Yes | URL to JSON Schema for this capability's payload. |

| extends | string | No | Parent capability this extends. Present for extensions, absent for root capabilities. |

| config | object | No | Capability-specific configuration (structure defined by each capability). |

Extensions¶

An extension is an optional module that augments another capability.

Extensions use the extends field to declare their parent:

{

"name": "dev.ucp.shopping.fulfillment",

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/fulfillment",

"schema": "https://ucp.dev/schemas/shopping/fulfillment.json",

"extends": "dev.ucp.shopping.checkout"

}

Extensions can be:

- Official:

dev.ucp.shopping.fulfillmentextendsdev.ucp.shopping.checkout - Vendor:

com.example.installmentsextendsdev.ucp.shopping.checkout

Schema Composition¶

Extensions can add new fields and modify shared structures (e.g., discounts

modify totals, fulfillment adds fulfillment to totals.type).

Requirements¶

- Transport definitions (OpenAPI/OpenRPC) MUST reference base schemas only. They MUST NOT enumerate fields or define payload shapes inline.

- Extensions MUST be self-describing. Each extension schema MUST

declare the types it introduces and how it modifies base types using

allOfcomposition. - Platforms MUST resolve schemas client-side by fetching and composing base schemas with active extension schemas.

Extension Schema Pattern¶

Extension schemas define composed types using allOf. An example is as follows:

{

"$defs": {

"discounts_object": { ... },

"checkout": {

"allOf": [

{"$ref": "checkout.json"},

{

"type": "object",

"properties": {

"discounts": {

"$ref": "#/$defs/discounts_object"

}

}

}

]

}

}

}

Composed type names MUST use the pattern: {capability-name}.{TypeName}

Resolution Flow¶

Platforms MUST resolve schemas following this sequence:

- Discovery: Fetch business profile from

/.well-known/ucp - Negotiation: Compute capability intersection (see Intersection Algorithm)

- Schema Fetch: Fetch base schema and all active extension schemas

- Compose: Merge schemas via

allOfchains based on active extensions - Validate: Validate requests and responses against the composed schema

Profile Structure¶

Business Profile¶

Businesses publish their profile at /.well-known/ucp. An example:

{

"ucp": {

"version": "2026-01-11",

"services": {

"dev.ucp.shopping": {

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/overview",

"rest": {

"schema": "https://ucp.dev/services/shopping/rest.openapi.json",

"endpoint": "https://business.example.com/ucp/v1"

},

"mcp": {

"schema": "https://ucp.dev/services/shopping/mcp.openrpc.json",

"endpoint": "https://business.example.com/ucp/mcp"

},

"a2a": {

"endpoint": "https://business.example.com/.well-known/agent-card.json"

},

"embedded": {

"schema": "https://ucp.dev/services/shopping/embedded.openrpc.json"

}

}

},

"capabilities": [

{

"name": "dev.ucp.shopping.checkout",

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/checkout",

"schema": "https://ucp.dev/schemas/shopping/checkout.json"

},

{

"name": "dev.ucp.shopping.fulfillment",

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/fulfillment",

"schema": "https://ucp.dev/schemas/shopping/fulfillment.json",

"extends": "dev.ucp.shopping.checkout"

},

{

"name": "dev.ucp.shopping.discount",

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/discount",

"schema": "https://ucp.dev/schemas/shopping/discount.json",

"extends": "dev.ucp.shopping.checkout"

}

]

},

"payment": {

"handlers": [

{

"id": "business_tokenizer",

"name": "com.example.business_tokenizer",

"version": "2026-01-11",

"spec": "https://example.com/specs/payments/business_tokenizer",

"config_schema": "https://example.com/specs/payments/merchant_tokenizer.json",

"instrument_schemas": [

"https://ucp.dev/schemas/shopping/types/card_payment_instrument.json"

],

"config": {

"type": "CARD",

"tokenization_specification": {

"type": "PUSH",

"parameters": {

"token_retrieval_url": "https://api.psp.example.com/v1/tokens"

}

}

}

}

]

},

"signing_keys": [

{

"kid": "business_2025",

"kty": "EC",

"crv": "P-256",

"x": "WbbXwVYGdJoP4Xm3qCkGvBRcRvKtEfXDbWvPzpPS8LA",

"y": "sP4jHHxYqC89HBo8TjrtVOAGHfJDflYxw7MFMxuFMPY",

"use": "sig",

"alg": "ES256"

}

]

}

The ucp object contains protocol metadata: version, services, and

capabilities. Payment configuration is a sibling—see

Payment Architecture. The signing_keys array

contains public keys (JWK format) used to verify signatures on webhooks and

other authenticated messages from the business.

Platform Profile¶

Platform profiles are similar and include signing keys for capabilities

requiring cryptographic verification. Capabilities MAY include a config

object for capability-specific settings (e.g., callback URLs, feature flags). An

example:

{

"ucp": {

"version": "2026-01-11",

"capabilities": [

{

"name": "dev.ucp.shopping.checkout",

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/checkout",

"schema": "https://ucp.dev/schemas/shopping/checkout.json"

},

{

"name": "dev.ucp.shopping.fulfillment",

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/fulfillment",

"schema": "https://ucp.dev/schemas/shopping/fulfillment.json",

"extends": "dev.ucp.shopping.checkout"

},

{

"name": "dev.ucp.shopping.order",

"version": "2026-01-11",

"spec": "https://ucp.dev/specification/order",

"schema": "https://ucp.dev/schemas/shopping/order.json",

"config": {

"webhook_url": "https://platform.example.com/webhooks/ucp/orders"

}

}

]

},

"payment": {

"handlers": [

{

"id": "gpay",

"name": "com.google.pay",

"version": "2024-12-03",

"spec": "https://developers.google.com/merchant/ucp/guides/gpay-payment-handler",

"config_schema": "https://pay.google.com/gp/p/ucp/2026-01-11/schemas/gpay_config.json",

"instrument_schemas": [

"https://pay.google.com/gp/p/ucp/2026-01-11/schemas/gpay_card_payment_instrument.json"

]

},

{

"id": "business_tokenizer",

"name": "dev.ucp.business_tokenizer",

"version": "2026-01-11",

"spec": "https://example.com/specs/payments/business_tokenizer-payment",

"config_schema": "https://ucp.dev/schemas/payments/delegate-payment.json",

"instrument_schemas": [

"https://ucp.dev/schemas/shopping/types/card_payment_instrument.json"

]

}

]

},

"signing_keys": [

{

"kid": "platform_2025",

"kty": "EC",

"crv": "P-256",

"x": "MKBCTNIcKUSDii11ySs3526iDZ8AiTo7Tu6KPAqv7D4",

"y": "4Etl6SRW2YiLUrN5vfvVHuhp7x8PxltmWWlbbM4IFyM",

"use": "sig",

"alg": "ES256"

}

]

}

Platform Advertisement on Request¶

Platforms MUST communicate their profile URI with each request to enable capability negotiation.

HTTP Transport: Platforms MUST use Dictionary Structured Field syntax (RFC 8941) in the UCP-Agent header:

POST /checkout HTTP/1.1

UCP-Agent: profile="https://agent.example/profiles/shopping-agent.json"

Content-Type: application/json

{"line_items": [...]}

MCP Transport: Platforms MUST use native dictionary structure in

_meta.ucp:

{

"jsonrpc": "2.0",

"method": "create_checkout",

"params": {

"_meta": {

"ucp": {

"profile": "https://agent.example/profiles/shopping-agent.json"

}

},

"line_items": [...]

},

"id": 1

}

Negotiation Protocol¶

Platform Requirements¶

- Profile Advertisement: Platforms MUST include their profile URI in every request using the transport-appropriate mechanism.

- Discovery: Platforms MAY fetch the business profile from

/.well-known/ucpbefore initiating requests. If fetched, platforms SHOULD cache the profile according to HTTP cache-control directives. - Namespace Validation: Platforms MUST validate that capability

specURI origins match namespace authorities. - Schema Resolution: Platforms MUST fetch and compose schemas for negotiated capabilities before making requests.

Business Requirements¶

- Profile Resolution: Upon receiving a request with a platform profile URI, businesses MUST fetch and validate the platform profile unless already cached.

- Capability Intersection: Businesses MUST compute the intersection of platform and business capabilities.

- Extension Validation: Extensions without their parent capability in the intersection MUST be excluded.

- Response Requirements: Businesses MUST include the

ucpfield in every response containing:version: The UCP version used to process the requestcapabilities: Array of active capabilities for this response

Intersection Algorithm¶

The capability intersection algorithm determines which capabilities are active for a session:

-

Compute intersection: For each business capability, include it in the result if a platform capability with the same

nameexists. -

Prune orphaned extensions: Remove any capability where

extendsis set but the parent capability is not in the intersection. -

Repeat pruning: Continue step 2 until no more capabilities are removed (handles transitive extension chains).

The result is the set of capabilities both parties support, with extension dependencies satisfied.

Error Handling¶

If negotiation fails, businesses MUST return an error response:

{

"status": "requires_escalation",

"messages": [{

"type": "error",

"code": "version_unsupported",

"message": "Version 2026-01-11 is not supported.",

"severity": "requires_buyer_input"

}]

}

Capability Declaration in Responses¶

The capabilities array in responses indicates active capabilities:

{

"ucp": {

"version": "2026-01-11",

"capabilities": [

{"name": "dev.ucp.shopping.checkout", "version": "2026-01-11"},

{"name": "dev.ucp.shopping.fulfillment", "version": "2026-01-11"}

]

},

"id": "checkout_123",

"line_items": [...]

... other fields

}

Payment Architecture¶

UCP adopts a decoupled architecture for payments to solve the "N-to-N" complexity problem between platforms, businesses, and payment credential providers. This design separates Payment Instruments (what is accepted) from Payment Handlers (the specifications for how instruments are processed), ensuring security and scalability.

Security and Trust Model¶

The payment architecture is built on a "Trust-by-Design" philosophy. It assumes that while the business and payment credential provider have a trusted legal relationship, the platform (Client) acts as an intermediary that SHOULD NOT touch raw financial credentials.

The Trust Triangle¶

- Business ↔ Payment Credential Provider: A pre-existing legal and technical relationship. The business holds API keys and a contract with the payment credential provider.

- Platform ↔ Payment Credential Provider: The platform interacts with the payment credential provider's interface (e.g., an iframe or API) to tokenize data but is not the "owner" of the funds.

- Platform ↔ Business: The platform passes the result (a token or mandate) to the business to finalize the order.

Enhanced Security for Autonomous Commerce¶

For scenarios requiring cryptographic proof of user authorization (e.g.,

autonomous AI agents), UCP supports the AP2 Mandates Extension

(dev.ucp.shopping.ap2_mandate). This optional extension provides

non-repudiable authorization through verifiable digital credentials.

See Transaction Integrity and AP2 Mandates Extension for details on when and how to use this extension.

Credential Flow & PCI Scope¶

To minimize compliance overhead (PCI-DSS):

- Unidirectional Flow: Credentials flow Platform → Business only. Businesses MUST NOT echo credentials back in responses.

- Opaque Credentials: Platforms handle tokens (such as network tokens), encrypted payloads, or mandates, not raw PANs.

- Handler ID Routing: The

handler_idin the payload ensures the business knows exactly which payment credential provider key to use for decryption/charging, preventing key confusion attacks.

Roles & Responsibilities: Who Implements What?¶

A common source of confusion is the division of labor. The UCP payment model splits responsibilities as follows:

| Role | Responsibility | Action |

|---|---|---|

| Payment Credential Provider | Defines the Spec | Creates the Handler Definition. They publish the "Blueprint" (JSON Schemas) that dictates how to tokenize a card and what config inputs are needed. Example: "Here is the schema for the 'com.psp-x.tokenization' handler." |

| Business | Configures the Handler | Selects the Handler they want to use and provides their specific Configuration (Public Keys, Merchant IDs) in the UCP Checkout Response. Example: "I accept Visa using 'com.psp-x.tokenization' with this Publishable Key." |

| Platform | Executes the Protocol | Reads the business's config and executes the logic defined by the payment credential provider's Spec to acquire a token. Example: "I see the Business uses a payment credential provider. I will call the provider's SDK with the Business's Key to get a token." |

Payment in the Checkout Lifecycle¶

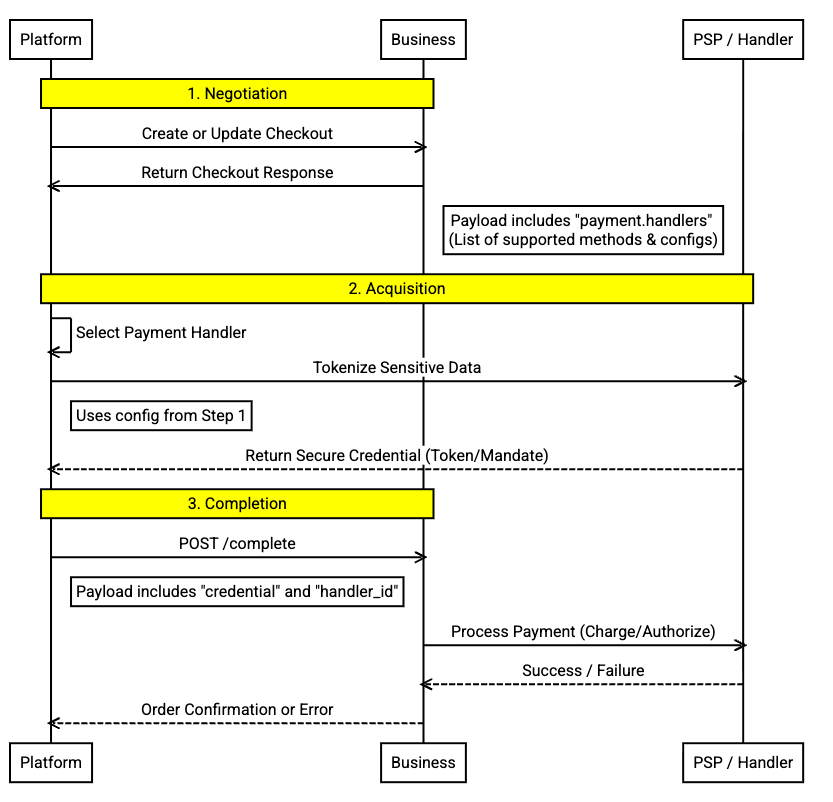

The payment process follows a standard 3-step lifecycle within UCP: Negotiation, Acquisition, and Completion.

- Negotiation (Business → Platform): The business analyzes the cart and advertises available

handlers. This tells the platform how to pay (e.g., "Use this specific payment credential provider endpoint with this public key"). - Acquisition (Platform ↔ Payment Credential Provider): The platform executes the handler's logic. This happens client-side or agent-side, directly with the payment credential provider (e.g., exchanging credentials for a network token). The business is not involved, ensuring raw data never touches the business's frontend API.

- Completion (Platform → Business): The platform submits the opaque credential (token) to the business. The business uses it to capture funds via their backend integration with the payment credential provider.

Payment Handlers¶

Payment Handlers are specifications (not entities) that define how payment instruments are processed. They are the contract that binds the three participants together.

Important distinction:

- Payment Credential Provider = The participant (entity like Google Pay, Stripe)

- Payment Handler = The specification the provider authors (e.g.,

com.google.pay)

Payment handlers allow for a variety of different payment instruments and token-types to be supported, including network tokens. They are standardized definitions typically authored by payment credential providers or the UCP governing body.

Dynamic Filtering: Businesses MUST filter the handlers list based on

the context of the cart (e.g., removing "Buy Now Pay Later" for subscription

items, or filtering regional methods based on shipping address).

Risk Signals¶

To aid in fraud assessment, the Platform MAY include additional risk signals

in the complete call, providing the Business with more context about the

transaction's legitimacy. The structure and content of these risk signals are

not strictly defined by this specification, allowing flexibility based on the

agreement between the Platform and Business or specific payment handler

requirements.

Example (Flexible Structure):

Implementation Scenarios¶

The following scenarios illustrate how different payment handlers and instruments are negotiated and executed using concrete data examples.

Scenario A: Digital Wallet¶

In this scenario, the platform identifies a digital wallet handler (e.g.,

com.google.pay, dev.shopify.shop_pay) and uses the wallet's API to acquire

an encrypted payment token.

1. Business Advertisement (Response from Create Checkout)

{

"payment": {

"handlers": [

{

"id": "8c9202bd-63cc-4241-8d24-d57ce69ea31c",

"name": "com.google.pay",

"version": "2026-01-11",

"spec": "https://pay.google.com/gp/p/ucp/2026-01-11/",

"config_schema": "https://pay.google.com/gp/p/ucp/2026-01-11/schemas/config.json",

"instrument_schemas": [

"https://pay.google.com/gp/p/ucp/2026-01-11/schemas/card_payment_instrument.json"

],

"config": {

"api_version": 2,

"api_version_minor": 0,

"environment": "TEST",

"merchant_info": {

"merchant_name": "Example Merchant",

"merchant_id": "01234567890123456789",

"merchant_origin": "checkout.merchant.com"

},

"allowed_payment_methods": [

{

"type": "CARD",

"parameters": {

"allowed_auth_methods": ["PAN_ONLY"],

"allowed_card_networks": ["VISA", "MASTERCARD"]

},

"tokenization_specification": {

"type": "PAYMENT_GATEWAY",

"parameters": {

"gateway": "example",

"gatewayMerchantId": "exampleGatewayMerchantId"

}

}

}

]

}

}

]

}

}

2. Token Execution (Platform Side)

The platform recognizes com.google.pay. It passes the config into the

Google Pay API. Google Pay returns the encrypted token data.

3. Complete Checkout (Request to Business) The Platform wraps the Google Pay response into a payment instrument.

POST /checkout-sessions/{id}/complete

{

"payment_data": {

"id": "pm_1234567890abc",

"handler_id": "8c9202bd-63cc-4241-8d24-d57ce69ea31c",

"type": "card",

"brand": "visa",

"last_digits": "4242",

"billing_address": {

"street_address": "123 Main Street",

"extended_address": "Suite 400",

"address_locality": "Charleston",

"address_region": "SC",

"postal_code": "29401",

"address_country": "US",

"first_name": "Jane",

"last_name": "Smith"

},

"credential": {

"type": "PAYMENT_GATEWAY",

"token": "{\"signature\":\"...\",\"protocolVersion\":\"ECv2\"...}"

}

},

"risk_signals": {

// ...

}

}

Scenario B: Direct Tokenization with Challenge (SCA)¶

In this scenario, the platform uses a generic tokenizer to request a session token or network tokens. The bank requires Strong Customer Authentication (SCA/3DS), forcing the business to pause completion and request a challenge.

1. Business Advertisement

{

"payment": {

"handlers": [{

"id": "merchant_tokenizer",

"name": "com.example.tokenizer",

// ... more handler required field

"config": {

"token_url": "https://api.psp.com/tokens",

"public_key": "pk_123"

}

}]

}

}

2. Token Execution (Platform Side)

The platform calls https://api.psp.com/tokens which identity SHOULD have

previous legal binding connection with them and receives tok_visa_123

(which could represent a vaulted card or network token).

3. Complete Checkout (Request to Business)

POST /checkout-sessions/{id}/complete

{

"payment_data": {

"handler_id": "merchant_tokenizer",

// ... more instrument required field

"credential": { "token": "tok_visa_123" }

},

"risk_signals": {

// ... host could send risk_signals here

}

}

4. Challenge Required (Response from Business)

The business attempts the charge, but the PSP returns a "Soft Decline" requiring 3DS.

HTTP/1.1 200 OK

{

"status": "requires_escalation",

"messages": [{

"type": "error",

"code": "requires_3ds",

"content": "bank requires verification.",

"severity": "requires_buyer_input"

}],

"continue_url": "https://psp.com/challenge/123"

}

The platform MUST now open continue_url in a WebView/Window for the user

to complete the bank check, then retry the completion.

Scenario C: Autonomous Agent (AP2)¶

This scenario demonstrates the Recommended Flow for Agents. Instead of a session token, the agent generates cryptographic mandates.

1. Business Advertisement

{

"payment": {

"handlers": [{

"id": "ap2_234352",

"name": "dev.ucp.ap2_mandate_compatible_handlers",

// ... other required handler fields

}]

}

}

2. Agent Execution

The agent cryptographically signs objects using the user's private key on a non-agentic surface.

3. Complete Checkout

POST /checkout-sessions/{id}/complete

{

"payment_data": {

"handler_id": "ap2_234352",

// other required instruments fields

"credential": {

"type": "card",

"token": "eyJhbGciOiJ...", // Token would contain payment_mandate, the signed proof of funds auth

}

},

"risk_signals": {

"session_id": "abc_123_xyz",

"score": 0.95

},

"ap2": {

"checkout_mandate": "eyJhbGciOiJ...", // Signed proof of checkout terms

}

}

This provides the business with non-repudiable proof that the user authorized this specific transaction, enabling safe autonomous processing.

PCI-DSS Scope Management¶

Platform Scope

Most platform implementations can avoid PCI-DSS scope by:

- Using handlers that provide opaque credentials (encrypted data, token references, etc.)

- Never accessing or storing raw payment data (card numbers, CVV, etc.)

- Forwarding credentials without the ability to use them directly

- Using PSP tokenization payment handlers where raw credentials never pass through the platform

Business Scope

Businesses can minimize PCI scope by:

- Using payment credential provider-hosted tokenization (provider stores credentials, business receives token reference)

- Using wallet providers that provide encrypted credentials (Google Pay, Shop Pay)

- Never logging raw credentials

- Delegating credential processing to PCI-certified payment credential providers

Payment Credential Provider Scope

Payment credential providers (PSPs, wallets) are typically PCI-DSS Level 1 certified and handle:

- Raw credential collection

- Credential protection (tokenization, encryption, secure storage)

- Credential validation and processing

- PCI-compliant infrastructure

Security Best Practices¶

For Businesses:

- Validate handler_id before processing (ensure handler is in advertised set)

- Use separate PSP credentials for TEST vs PRODUCTION environments

- Implement idempotency for payment processing (prevent double-charges)

- Log payment events without logging credentials

- Set appropriate credential timeouts

- For autonomous commerce scenarios requiring cryptographic proof, consider

supporting the

dev.ucp.shopping.ap2_mandateextension (see AP2 Mandates Extension)

For Platforms:

- Always use HTTPS for checkout API calls

- Validate handler configurations before executing protocols

- Implement timeout handling for credential acquisition

- Clear credentials from memory after submission

- Handle credential expiration gracefully (re-acquire if needed)

- For autonomous agents, consider using the

dev.ucp.shopping.ap2_mandateextension for cryptographic proof of authorization (see AP2 Mandates Extension)

For Payment Credential Providers:

- Secure credentials for the specific business (encryption, tokenization, or other handler-specific methods)

- Implement rate limiting on credential acquisition

- Validate platform authorization before providing credentials

- Set reasonable credential expiration (e.g., 15 minutes for tokens, time- limited encrypted payloads)

- Ensure credentials cannot be used by platforms directly (only by the intended business)

Fraud Prevention Integration¶

While UCP does not define fraud prevention APIs, the payment architecture supports fraud signal integration:

- Businesses can require additional fields in handler configurations (e.g., 3DS requirements)

- Platforms can submit device fingerprints and session data alongside credentials

- Payment credential providers can perform risk assessment during credential acquisition

- Businesses can reject high-risk transactions and request additional verification

Future extensions MAY standardize fraud signal schemas, but the current architecture allows flexible integration with existing fraud prevention systems.

Payment Architecture Extensions¶

The core payment architecture described above can be extended for specialized use cases:

-

AP2 Mandates Extension (

dev.ucp.shopping.ap2_mandate): Adds cryptographic proof of user authorization for autonomous commerce scenarios where non-repudiable evidence is required. See AP2 Mandates Extension. -

Custom Handler Types: Payment credential providers can define custom handlers to support new payment instruments. See Payment Handler Guide for details.

The extension model ensures the core architecture remains simple while supporting advanced security and compliance requirements when needed.

Transport Layer¶

UCP supports multiple transport protocols. Platforms and businesses effectively

negotiate the transport via services on their profiles.

REST Transport (Core)¶

The primary transport for UCP is HTTP/1.1 (or higher) using RESTful patterns.

- Content-Type: Requests and responses MUST use

application/json. - Methods: Implementations MUST use standard HTTP verbs (e.g.,

POSTfor creation,GETfor retrieval). - Status Codes: Implementations MUST use standard HTTP status codes (e.g., 200, 201, 400, 401, 500).

Model Context Protocol (MCP)¶

UCP capabilities map 1:1 to MCP tools. A business MAY expose an MCP server

that wraps their UCP implementation, allowing LLMs to call tools like

create_checkout directly.

Agent-to-Agent Protocol (A2A)¶

A business MAY expose an A2A agent that supports UCP as an A2A Extension, allowing integration with platforms over structured UCP data types.

Embedded Protocol (EP)¶

A business MAY embed an interface onto an eligible host that would receive events as the user interacts with the interface and delegate key user actions.

Initiation comes through a continue_url that is returned by the business.

Standard Capabilities¶

UCP defines a set of standard capabilities:

| Capability Name | ID (URI) | Description |

|---|---|---|

| Checkout | https://ucp.dev/schemas/shopping/checkout.json |

Facilitates the creation and management of checkout sessions, including cart management and tax calculation. |

| Identity Linking | - | Enables platforms to obtain authorization via OAuth 2.0 to perform actions on a user's behalf. |

| Order | https://ucp.dev/schemas/shopping/order.json |

Allows businesses to push asynchronous updates about an order's lifecycle (shipping, delivery, returns). |

Definition & Extensions¶

Detailed definitions for endpoints, schemas, and valid extensions for each capability are provided in their respective specification files. Extensions are typically versioned and defined alongside their parent capability.

Security & Authentication¶

Transport Security¶

All UCP communication MUST occur over HTTPS.

Request Authentication¶

- Platform to Business: Requests SHOULD be authenticated using

standard headers (e.g.,

Authorization: Bearer <token>). - Business to Platform (Webhooks): Webhooks MUST be signed using a shared secret or asymmetric key to verify integrity and origin.

Data Privacy¶

Sensitive data (such as Payment Credentials or PII) MUST be handled according to PCI-DSS and GDPR guidelines. UCP encourages the use of tokenized payment data to minimize business and platform liability.

Transaction Integrity and Non-Repudiation¶

For scenarios requiring cryptographic proof of authorization (e.g., autonomous

agents, high-value transactions), UCP supports the AP2 Mandates Extension

(dev.ucp.shopping.ap2_mandate). When this optional extension is negotiated:

- Businesses provide a cryptographic signature on checkout terms

- Platforms provide cryptographic mandates proving user authorization

This mechanism provides strong, end-to-end cryptographic assurances about transaction details and participant consent, significantly reducing risks of tampering and disputes.

See AP2 Mandates Extension for complete specification, implementation guide, and examples.

Versioning¶

Version Format¶

UCP uses date-based versioning in the format YYYY-MM-DD. This provides

clear chronological ordering and unambiguous version comparison.

Version Discovery and Negotiation¶

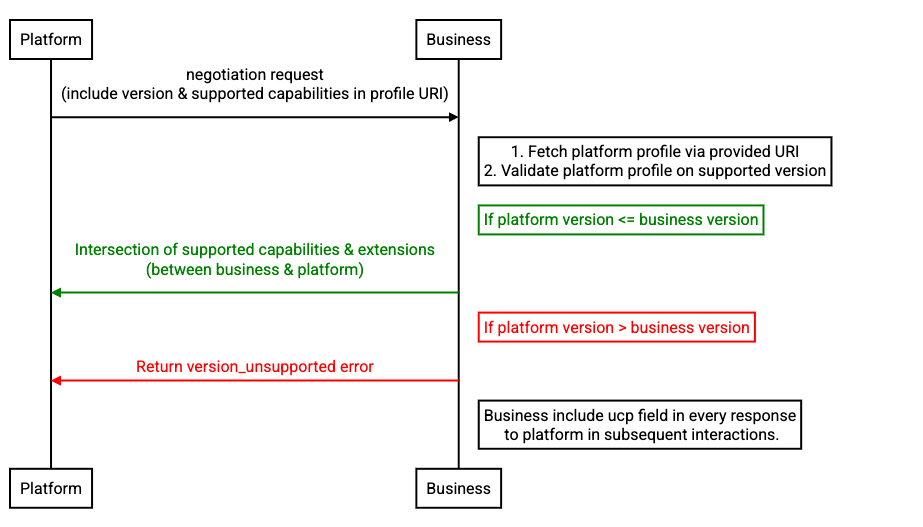

UCP prioritizes strong backwards compatibility. Businesses implementing a version SHOULD handle requests from platforms using that version or older.

Both businesses and platforms declare a single version in their profiles:

Example¶

Version Negotiation¶

Businesses MUST validate the platform's version and determine compatibility:

- Platform declares version via profile referenced in request

- Business validates:

- If platform version ≤ business version: Business MUST process the request

- If platform version > business version: Business MUST return

version_unsupportederror

- Businesses MUST include the version used for processing in every response.

Response with version confirmation:

{

"ucp": {

"version": "2026-01-11",

"capabilities": [ ... ]

},

"id": "checkout_123",

"status": "incomplete"

...other checkout fields

}

Version unsupported error:

{

"status": "requires_escalation",

"messages": [{

"type": "error",

"code": "version_unsupported",

"message": "Version 2026-01-12 is not supported. This business implements version 2026-01-11.",

"severity": "requires_buyer_input"

}]

}

Backwards Compatibility¶

Backwards-Compatible Changes¶

The following changes MAY be introduced without a new version:

- Adding new non-required fields to responses

- Adding new non-required parameters to requests

- Adding new endpoints, methods, or operations to a transport

- Adding new error codes with existing error structures

- Adding new values to enums (unless explicitly documented as exhaustive)

- Changing the order of fields in responses

- Changing the length or format of opaque strings (IDs, tokens)

Breaking Changes:¶

The following changes MUST NOT be introduced without a new version:

- Removing or renaming existing fields

- Changing field types or semantics

- Making non-required fields required

- Removing operations, methods, or endpoints

- Changing authentication or authorization requirements

- Modifying existing protocol flow or state machine

- Changing the meaning of existing error codes

Independent Component Versioning¶

- UCP protocol versions independently from capabilities.

- Each capability versions independently from other capabilities.

- Capabilities MUST follow the same backwards compatibility rules as the protocol.

- Businesses MUST validate capability version compatibility using the same logic as what's described above.

- Transports MAY define their own version handling mechanisms.

UCP Capabilities (dev.ucp.*)¶

UCP-authored capabilities version with protocol releases by default. Individual capabilities MAY version independently when breaking changes are required outside the protocol release cycle.

Vendor Capabilities (com.{vendor}.*)¶

Capabilities outside the dev.ucp.* namespace version fully independently.

Vendors control their own release schedules and versioning strategy.

Glossary¶

| Term | Acronym | Definition |

|---|---|---|

| Agent Payments Protocol | AP2 | An open protocol designed to enable AI agents to securely interoperate and complete payments autonomously. UCP leverages AP2 for secure payment mandates. |

| Agent2Agent Protocol | A2A | An open standard for secure, collaborative communication between diverse AI agents. UCP can use A2A as a transport layer. |

| Capability | - | A standalone core feature that a business supports (e.g., Checkout, Identity Linking). Capabilities are the fundamental "verbs" of UCP. |

| Credential Provider | CP | A trusted entity (like a digital wallet) responsible for securely managing and executing the user's payment and identity credentials. |

| Extension | - | An optional capability that augments another capability via the extends field. Extensions appear in ucp.capabilities[] alongside core capabilities. |

| Profile | - | A JSON document hosted by businesses and platforms at a well-known URI, declaring their identity, supported capabilities, and endpoints. |

| Business | - | The entity selling goods or services. In UCP, they act as the Merchant of Record (MoR), retaining financial liability and ownership of the order. |

| Model Context Protocol | MCP | A protocol standardizing how AI models connect to external data and tools. UCP capabilities map 1:1 to MCP tools. |

| Universal Commerce Protocol | UCP | The standard defined in this document, enabling interoperability between commerce entities via standardized capabilities and discovery. |

| Payment Service Provider | PSP | The financial infrastructure provider that processes payments, authorizations, and settlements on behalf of the business. |

| Platform | - | The consumer-facing surface (AI agent, app, website) acting on behalf of the user to discover businesses and facilitate commerce. |

| Verifiable Digital Credential | VDC | An Issuer-signed credential (set of claims) whose authenticity can be verified cryptographically. Used in UCP for secure payment authorizations. |

| Verifiable Presentation | VP | A presentation of one or more VDCs that includes a cryptographic proof of binding, used to prove authorization to a business or PSP. |